deadline to pay mississippi state taxes

Ad Filing Taxes Is Simple When You File With The Trusted Leader In Taxes. The 2021 mississippi state income tax return forms for tax year 2021 jan.

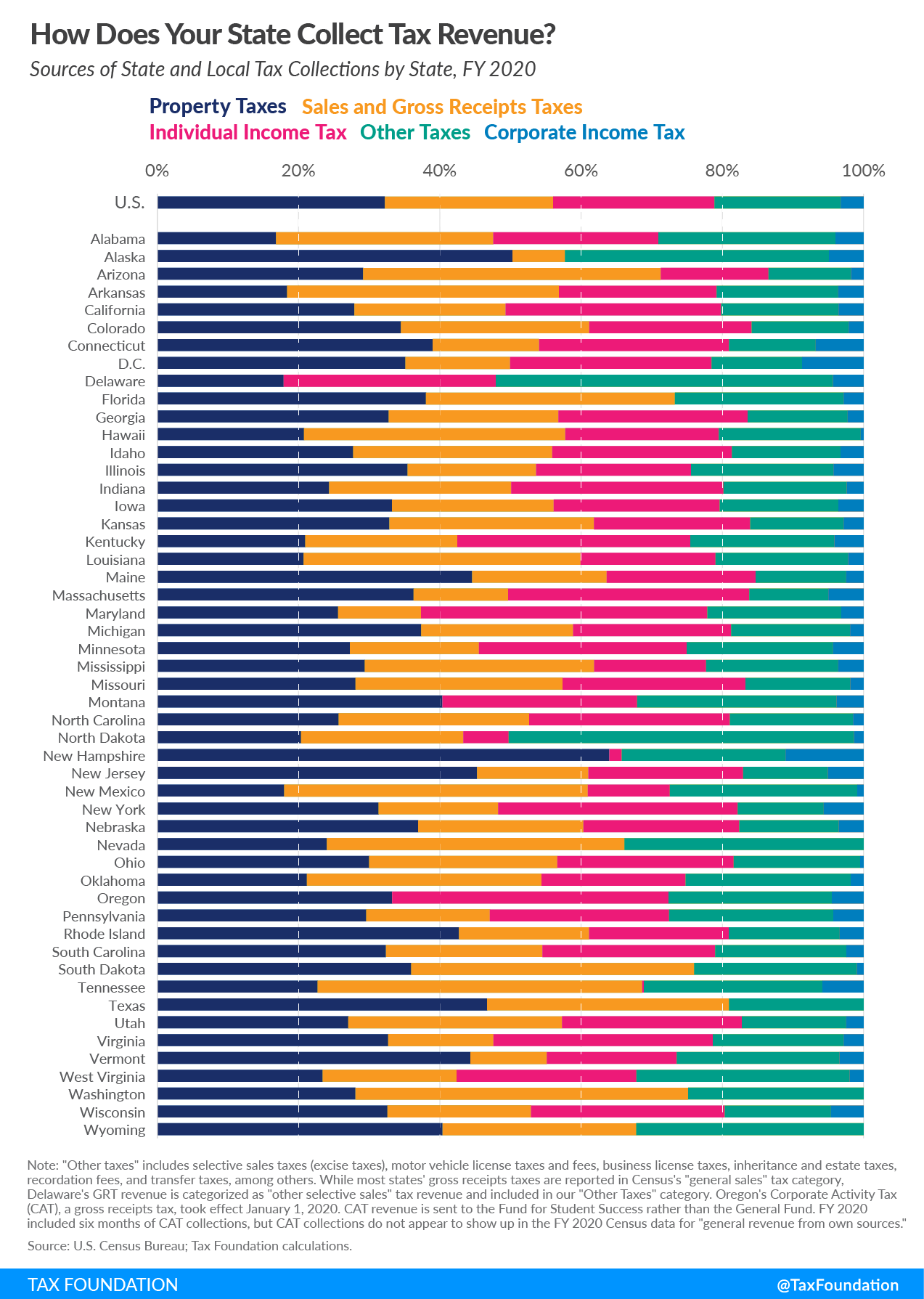

The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses.

. Web Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on time you get a 90 tax credit on FUTA. Get Your Maximum Refund Guaranteed When You File With Americas 1 Tax Software. While the state will automatically waive late-payment penalties for payments remitted by May 17 2021 interest will still accrue from April 15 2021 through the actual payment date.

Web In March the state moved the deadline to file and pay 2019 individual income tax to May 15 2020. In march the state moved the deadline to file and pay 2019 individual income tax to may 15 2020. Web The deadline to file and pay 2019 Mississippi individual and corporate income taxes has been extended to May 15In consultation with Gov.

First quarter 2020 Mississippi estimated tax payments were also extended to May 15. Teachers across the state are having trouble separating the teacher pay raise and income tax cut proposals. The tax rates are as follows.

There is no individual income tax. The 2021 mississippi state income tax return forms for tax year 2021 jan. 2020 hurricane ida filing extension.

The annual mid-May deadline to file Mississippi state income tax returns is still in effect. 3rd Quarter Due. The Federal or IRS Taxes Are Listed.

Pay by credit card or. Section 27-31-1 to 27-53-33 All property real and personal is appraised at true value and assessed at a percentage of true value according to its type and use. WCBI If youre a property owner in Mississippi its time to pay up.

Counties in mississippi collect an average of 052 of a propertys assesed fair market value as property tax per year. Web The state tax filing and payment deadline as well as deadline to pay 2021 estimated income taxes has been moved to June 15 2021 after many were impacted by winter storms in February. Web The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan.

3 on the next 3000 of taxable income. The state tax filing and payment deadline has been moved to May 17 2021. Web Property tax deadline passed in Mississippi August 23 2018 WINSTON COUNTY Miss.

The thresholds break down like this. Web The Mississippi Income Tax Estimator Lets You Calculate Your State Taxes For the Tax Year. 0 on the first 2000 of taxable income.

3 percent of income from 3001 to 5000. Tate Reeves and our legislative leadership the Mississippi Department of Revenue is providing relief to individual and business taxpayers due to the COVID-19 pandemic state officials said in a Monday. Web Real and Personal Property Land Rolls Deadline the due date for Real and Personal Land Rolls furnished from County Tax Assessors to Boards of Supervisors has been extended for 30 days.

Assessment ratios are 10 15 and 30. This year a number of state legislatures considered. Mississippis SUI rates range from 0 to 54.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due dateIf you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on. Web Property Tax main page forms schedules millage rates county officials etc Ad Valorem Tax Miss. The only exception is if.

Web Taxpayers should pay their federal income tax due by May 17 2021 to avoid interest and penalties. Web Federal Income Tax Deadline In 2022 Smartasset Pay by credit card or. 5 on all taxable income over 10000.

4 on the next 5000 of taxable income. 0 percent on income up to 3000. Web But since then lawmakers have largely focused their time and energy into cutting or eliminating the states income tax which generates billions in revenue that helps pay those teacher salaries among many other critical public services.

Web 8 hours agoMississippi Follows the National Pass-Through Entity Tax Election Trend Start Now to Make a 2022 Tax Election. Box 23050 Jackson MS 39225-3050. Mississippi taxes income at rates of 0 percent 3 percent 4 percent and 5 percent as of 2021.

Thursday August 25 2022. Prepare Pay Taxes. Web How Much Should You Pay in Mississippi State Tax.

4 percent of income from 5001 to 10000. Web Counties in mississippi collect an average of 052 of a propertys assesed fair market value as property tax per year. Mississippi Storm and Flooding Relief.

Ad No Money To Pay IRS Back Tax. Web What Are the Tax Rates in Mississippi. The taxable wage base in 2022 is 14000 for each employee.

Federal Income Tax Deadline In 2022 Smartasset

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

Figure Pay Qualities With Our Free Pay Charge Instrument That Will Pull In Salaried Stars Of Government And Private D Income Tax Return Income Tax Filing Taxes

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Cpram Offers Communication Majors Scholarships Scholarships Scholarships Application College Junior

When Are Taxes Due In 2022 Forbes Advisor

Tax Deadline Extension What Is And Isn T Extended Smartasset

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)