crypto tax calculator usa

Crypto-related expenses Tax and profit Your profit from crypto 20000 12300 tax-free CGT allowance Capital Gains Tax to pay 770 Profit after tax 19230 Calculation details Click here. Its equipped with tools that allow users to track the crypto market analyze their portfolio.

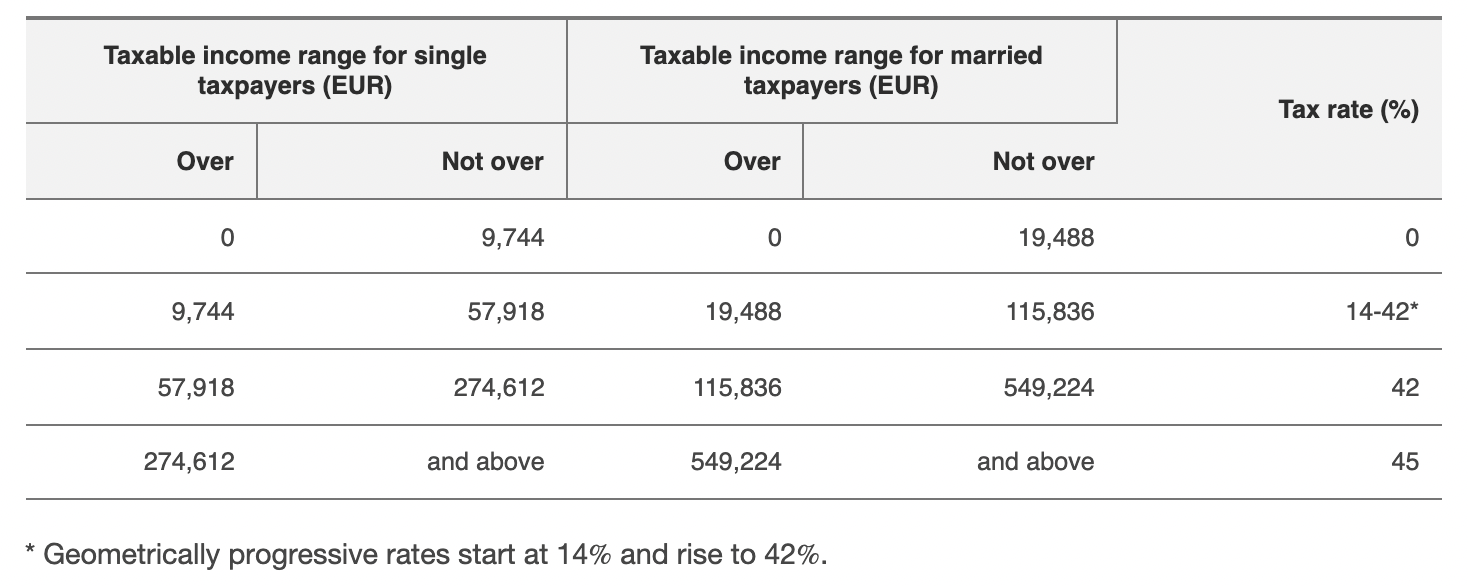

How Does Germany Taxes Crypto How Much Tax Do You Pay On Crypto In Germany Is It Really Tax Free

Check out our free Cryptocurrency Tax Interactive Calculator that in just one screen will answer your burning questions about your cryptocurrencyBitcoin sales and give.

. Easily file all your crypto taxes. Our free tool uses the following formula to calculate your capital gains and losses. You may have to dust off the math.

If you are using ACB Adjusted cost base method the cost basis of sale will be determined by. This crypto tax calculator can work for hobbyists and advanced crypto traders. Crypto Tax Calculator Use the calculator below to estimate the tax bill for your cryptocurrencyBitcoin sales.

Crypto taxes in the UK are pretty similar to that of the US Capital gain taxes on disposal of cryptocurrency and income taxes on crypto received as income or revenue. Select the tax year you would like to calculate your estimated taxes. After youve pulled together all the above information you can calculate what you owe in taxes.

You have investments to make. Through our software we manage to calculate your taxable income and gains based on your entire transaction history. USA Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate.

Stop worrying about record keeping filing keeping up to date with the evolving crypto tax code. You can automatically import all your transactions from over 300. Capital GainCapital Loss Purchase Price - Sell Price - Fees.

CURRENT FILING STATUS Estimated Taxable Income Cost. 1 Add data from hundreds of sources Directly upload your transaction history via CSV or API. Once weve calculated your gainloss.

As a refresher short-term capital gains had a rate of 10 to 37 in 2021. Select your tax filing status. Enter Your Personal Details.

Dont have an account. It only takes 5 clicks to get your customized crypto tax report for the US. Let us handle the formalities.

In this example the cost basis of the 2 BTC disposed would be 35000 10000 500002. Calculate Your Crypto Taxes. 19 hours agoThe winneror winnerswill owe 24 to the IRS in federal taxes and then additional taxes when they file winning that much money will put you in the top federal tax.

We generate a Crypto Tax Report with a summary of all your taxable trades and. Use our crypto tax calculator. Let us do that for you.

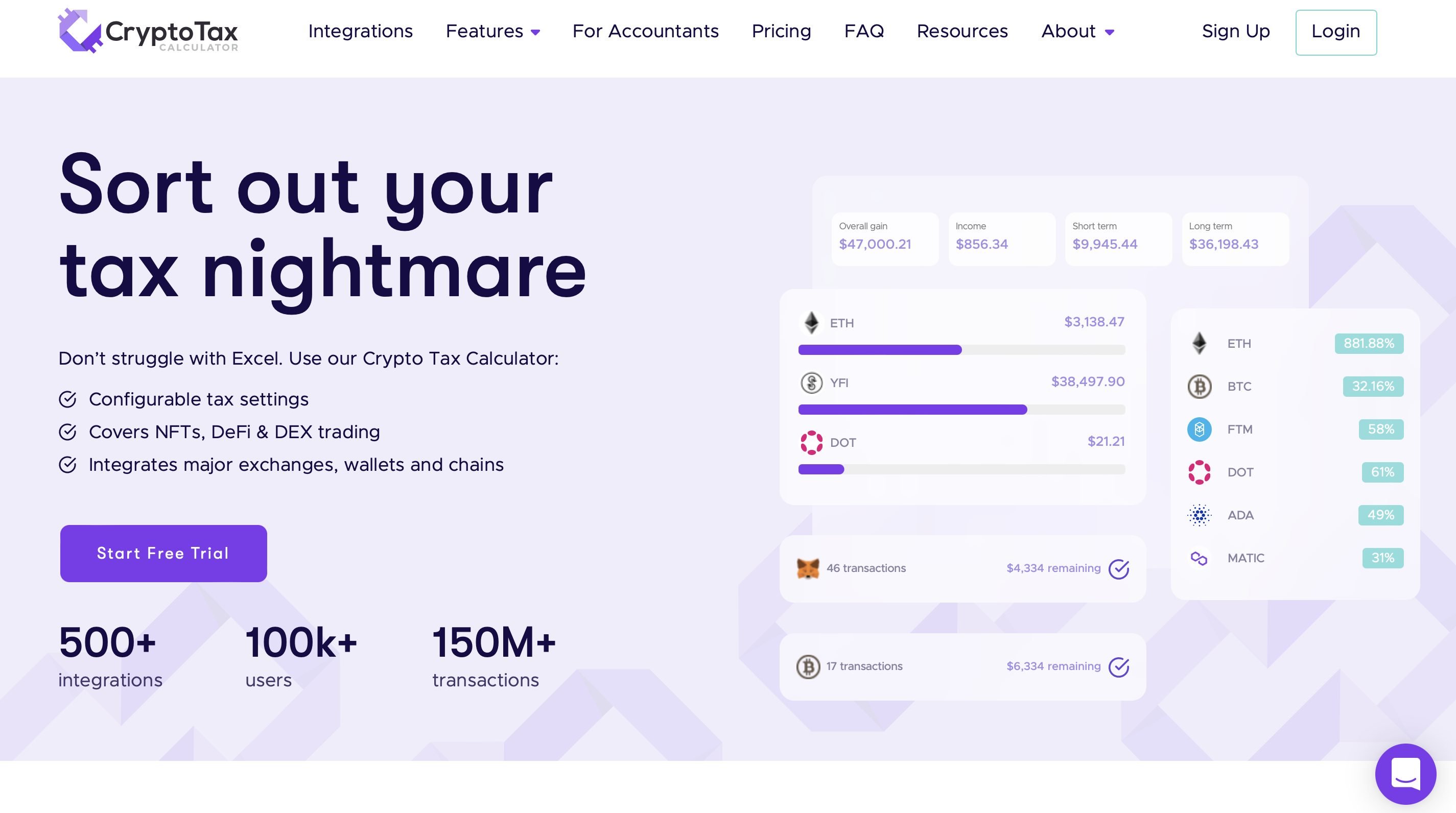

This means you may owe taxes if your coins have increased in value whether youre using them as an investment or like you would cash. CryptoTaxCalculator helps ease the pain of preparing your crypto taxes in a few easy steps. Enter your taxable income.

Cryptotaxcalculator Io Review 2022 Is Cryptotaxcalculator Legit Safe

6 Best Crypto Tax Software S 2022 Calculate Taxes On Crypto

Tokentax Review 2022 Is Token Tax A Good Crypto Tax Calculator

Crypto Tax Calculator Australia 2022 Calculate Profit And Tax For Free Marketplace Fairness

Koinly Vs Coinledger Io Ex Cryptotrader Tax Which Tax Calculator Is Better Captainaltcoin

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick

11 Best Crypto Tax Calculators To Check Out

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Cryptocurrency Bitcoin Taxes Complete Tax Guide 2022

Crypto Tax 2021 A Complete Us Guide Coindesk

Tax Calculator Github Topics Github

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

10 Best Crypto Tax Software In 2022 Top Selective Only

11 Best Crypto Tax Calculators To Check Out

Cryptocurrency Tax Calculator Nerdwallet

Best Crypto Tax Software Top Solutions For 2022

Capital Gains Tax Calculator Ey Us